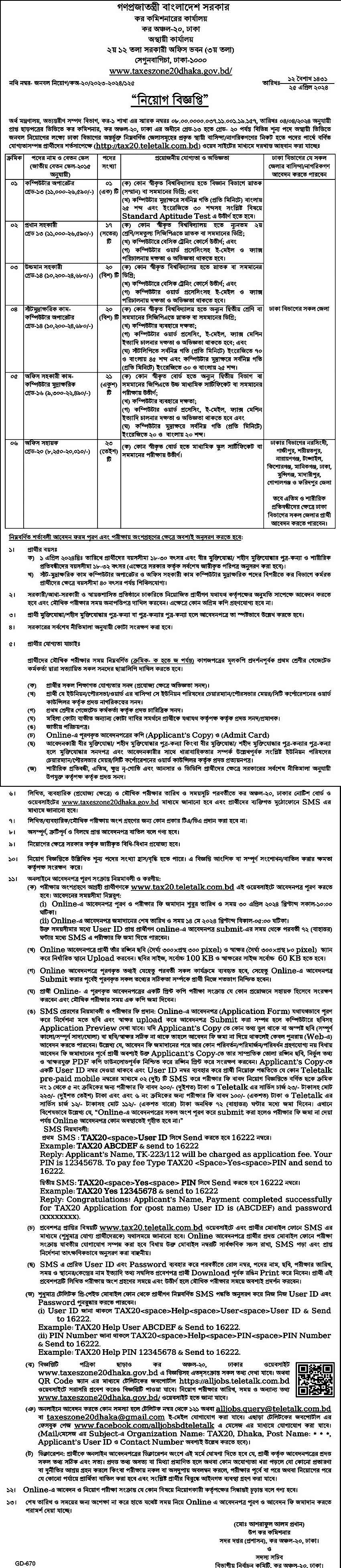

Tax Commission Office Job Circular 2024 has been found on my website. Tax Commission Office Job Circular has also been published on their official website. The Tax Commission Office is a huge opportunity for unemployed people in Bangladesh. The Tax Commission Office is one of the important parts of our country. Taxes Commission Office has been offered to the people of Bangladesh for exciting career opportunities in Taxes Zone One Dhaka. Tax Commission Office thinks that young and energetic people are the key to success in this sector creating brightness of Taxes Zone One Dhaka.

Tax Commission Office Job Circular 2024

Tax Commission Office has published a job offer containing a few categories. The Tax Commission Office Job is a huge opportunity for unemployed people who want to work in this sector. Tax Commission Office’s original job circular was converted to an image file so that everyone can read it easily or download this job circular. The Tax Commission Office job circular related to all information has been found on my website. The Tax Commission Office job is the most important zone in Bangladesh. With the job chances in the Tax Commission Office, anyone can take this opportunity. Tax Commission Office Job Circular 2024.

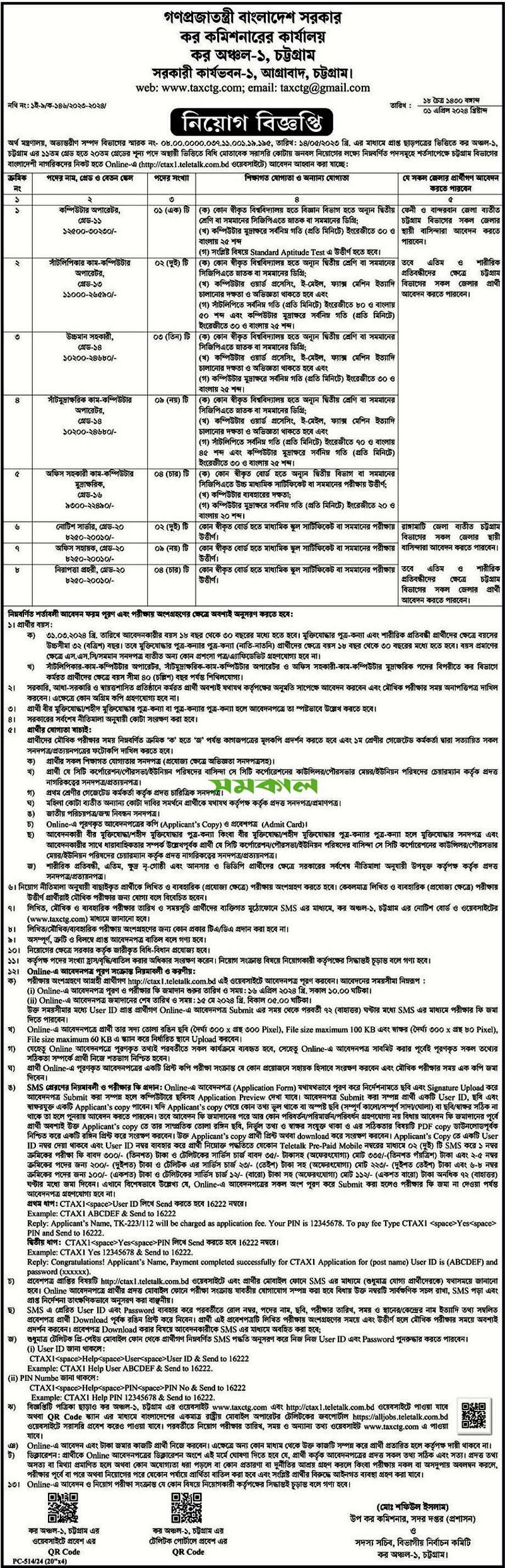

Tax Commission Office Job Circular has been published. Incomes Tax Office Job Circular Dhaka Zone One, Chittagong Income Tax Job Circular, and Income Tax Job application form are search options to apply in Tax Commissioner Office Job Circular. Tax Commission Office jobs are good career opportunities for unemployed people in Bangladesh. If you want to income tax office job circular, then you apply for this position.

Tax Commission office job circular published on their official website. Tax commission office job circular is a very attractive government job in Bangladesh. Nowadays government jobs are very attractive to young job seekers in Bangladesh. Tax Commission Office offered attractive salaries including another service benefit. You can check here the job circular given below.

Tax Commission Office Job Details 2024

Tax Commission Office Job Summary

■ Job Title: See Job Advertisement

■ Job Description: This job position is experienced, talented, and smart job circular, the authority for further review and selection purposes.

■ Published Date: April 30, 2024

■ Application Online Start: April 30, 2024 & May 06, 2024

■ Application Deadline: May 14, 2024 & May 18, 2024

■ Job Nature: Full-time

■ Job Type: Government (Tax Commissioners)

■ Employment Type: Permanent

■ Education Qualification: See Job Advertisement

■ Job Experience: See Job Advertisement

■ Gender: Both (Male & Female)

■ Compensation and Benefit: As per Government 8th Pay-scale 2015.

■ How to Apply: Apply to Online [http://btax.teletalk.com.bd/]

■ Job Location: Anywhere in Bangladesh

■ Age Limit: 30 years and 32 Child of Freedom Fighter

Tax Commission Office Job Notice 2024

Tax Commission Office Job News 2024

The Tax Commissioner’s Office is the most important Tax authority in Bangladesh. The main responsibility of NBR is to mobilize domestic resources through the collection of import duties and taxes, VAT, and income tax for the government. The National Board of Revenue (NBR) is under the ministry of finance.

The Income Tax Office published a job recruitment notice at Taxes Zone One Dhaka. Income Tax Office Job Circular is some new vacant position. You can know that Tax Commission Office job recruitment positions are applied now. Tax Commission Office Job Circular 2024.

The Tax Commission Office serves as a vital entity in any country’s governance structure, responsible for revenue collection, tax administration, and ensuring compliance with tax laws. With the complexity of modern economies, the demand for skilled professionals in tax administration has surged. Recently, the Tax Commission Office released a job circular, signaling opportunities for prospective candidates. This article aims to dissect the circular, providing insights into the roles, requirements, and significance of working within the Tax Commission Office.

Understanding the Job Circular

The Tax Commission Office job circular typically outlines various positions available, such as tax inspectors, auditors, analysts, and administrative staff. Each role carries distinct responsibilities tailored to the efficient functioning of tax administration. Tax inspectors are tasked with conducting field visits, verifying tax compliance, and educating taxpayers on their obligations. Auditors delve into financial records, ensuring accuracy and detecting any discrepancies. Analysts utilize data analytics to assess tax trends, forecast revenues, and formulate policies. Administrative staff play a crucial role in managing paperwork, facilitating communication, and supporting overall operations.

Tax Commission Office Job Update 2024

Key Requirements

The job circular enumerates essential requirements for prospective applicants, including educational qualifications, skills, and personal attributes. A degree in accounting, finance, economics, or a related field is often a prerequisite, demonstrating the necessary understanding of financial principles. Additionally, certifications such as CPA (Certified Public Accountant) or ACCA (Association of Chartered Certified Accountants) may be advantageous. Proficiency in relevant software applications, strong analytical abilities, and attention to detail are highly desirable traits. Moreover, effective communication skills and the ability to work under pressure are often emphasized, reflecting the dynamic nature of tax administration.

Significance of Working in Tax Administration

Employment within the Tax Commission Office carries significant implications, both professionally and socially. Firstly, it offers a platform to contribute directly to national development by ensuring the efficient collection of revenues essential for funding public services and infrastructure. Tax administrators play a pivotal role in maintaining the integrity of the tax system, thereby fostering a conducive environment for economic growth and investment. Furthermore, working in tax administration provides a unique opportunity for continuous learning and professional development. The complexity of tax laws and evolving business landscapes necessitate ongoing training and skill enhancement, making it an intellectually stimulating career choice. Additionally, tax administration fosters a sense of social responsibility, as it entails promoting compliance, fairness, and transparency in revenue collection, thereby contributing to social equity and justice.

Tax Commission Office Job Guideline 2024

Challenges and Opportunities

Despite its significance, working in tax administration presents various challenges. Tax administrators often encounter resistance from non-compliant taxpayers, necessitating effective communication and negotiation skills to ensure compliance. Moreover, staying abreast of constantly changing tax laws and regulations can be daunting, requiring a proactive approach to learning and adaptation. However, these challenges also present opportunities for growth and innovation. Embracing technological advancements, such as automation and data analytics, can streamline processes and enhance efficiency. Additionally, fostering collaboration with other government agencies, academic institutions, and international organizations can enrich knowledge exchange and best practices sharing.

Tax Commission Office Job Circular 2024

The Tax Commission Office job circular represents more than just a recruitment drive; it symbolizes opportunities for individuals to contribute meaningfully to national development while pursuing a rewarding career path. By understanding the intricacies of the circular, prospective candidates can prepare themselves effectively and embark on a fulfilling journey within tax administration. Beyond the tangible requirements, success in this field hinges on a commitment to integrity, professionalism, and continuous learning. Aspiring tax administrators hold the key to shaping a fair, transparent, and prosperous fiscal landscape, driving positive change for generations to come.

The Income Tax Office published a job recruitment notice at Taxes Zone One Dhaka job online application will start soon. Now you can check the tax commission office job circular given below in the image file. Tax Commissioner’s Office or income tax office Jobs Circular related all information has been found on my website. Tax Commission Office original jobs circular are found on my website https://taxeszone2.gov.bd/.